south dakota vehicle sales tax rate

Average Sales Tax With Local. The state sales tax rate in South Dakota is 4500.

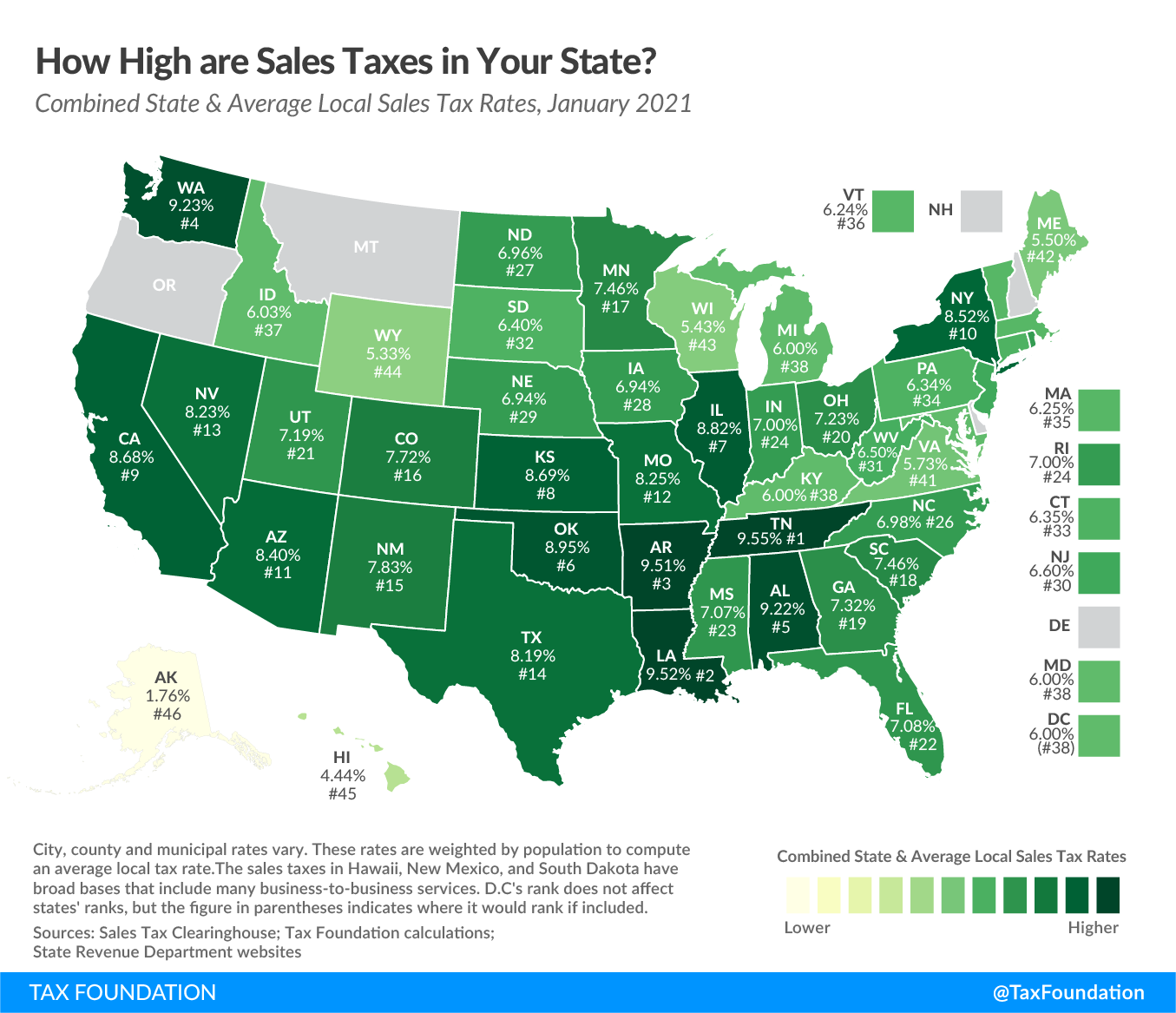

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Can I import a vehicle into South Dakota for the lone purpose of repair or modification.

. South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. 45 The following tax may apply in addition to the state sales tax. July 2022 httpsdorsdgov 1-800-829-9188 Lease and Rentals South Dakota.

Mobile Manufactured homes are subject to the 4 initial registration fee. If a state with no tax or a lower tax rate than South Dakotas 4 then you will need to pay the additional tax rate to match the 4. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6.

The following tax may apply in additionto the state sales tax. 2 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases. Municipalities may impose a general municipal sales tax rate of up to 2.

Registrations are required within 45 days of the purchase date. Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. For additional information on sales tax please refer to our Sales Tax Guide PDF.

The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes alcohol taxes admissions taxes and taxes on eating establishments. The information contained in this fact sheet is current as of the date of publication. South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1814 on top of the state tax.

Car sales tax in South Dakota is 4 of the price of the car. Its important to note that this does include any local or county sales tax which can go up to 35 for a total sales tax rate of 75. Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax.

Municipal Sales Tax and Use Tax Applies to. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. All car sales in South Dakota are subject to the 4 statewide sales tax.

South Dakota has a higher state sales tax. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership.

Different areas have varying additional sales taxes as well. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. What Rates may Municipalities Impose.

You can find these fees further down on the page. Motor Vehicles Sales and Purchases. With local taxes the total sales tax rate is between 4500 and 7500.

South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. The purpose of this Tax Fact is to explain how South Dakota state and local taxes apply to motor vehicle lease and rentals.

The South Dakota SD state sales tax rate is currently 45. Exemption from excise tax for motor vehicles leased to tax exempt entities. In addition for a car purchased in South Dakota there are other applicable fees including registration title.

There are a total of 289 local tax jurisdictions across the state collecting an average local tax of 1814. All fees are assessed from purchase date regardless of when an applicant applies for title and registration. If you rent or lease a motor vehicle for 28 days or less to customers in south dakota the rental fee is subject to 4 ½ wireless gross receipts tax.

South Dakota Taxes and Rates. 4 State Sales Tax and Use Tax Applies to all sales or purchases of taxable products and services. Average Local State Sales Tax.

You have 90 days from your date of arrival to title and license your vehicle in South Dakota. 4 State Sales Tax and Use Tax Applies to all sales or purchases of taxable products and services. Motor Vehicle Repair Services.

South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. How Much Is the Car Sales Tax in South Dakota. The South Dakota Department of Revenue administers these taxes.

Sales Tax Rate Charts. South Dakota has recent rate changes Thu Jul 01 2021. Motor Vehicle Sales or Purchases.

South Dakotas sales and use tax rate is 45 percent. All fees are assessed from. Depending on local municipalities the total tax rate can be as high as 65.

South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. However the average total tax rate in South Dakota is 5814. Applies to all sales of products and services that are subject to the state sales tax or use tax if the purchaser receives or imposes a sales tax or use tax.

Other local-level tax rates in the state of South Dakota are quite complex compared against local-level tax rates in other states. The South Dakota sales tax and use tax rates are 45. Other taxes include telecommunications taxes tourism taxes and motor vehicle taxes.

Select the South Dakota city from the list of popular cities below to see its current sales tax rate. What is South Dakotas Sales Tax Rate. It is not intended to answer all questions that may arise.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45.

The state sales and use tax rate is 45. South dakota collects a 4 state sales tax rate on the purchase of all vehicles.

State Corporate Income Tax Rates And Brackets Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

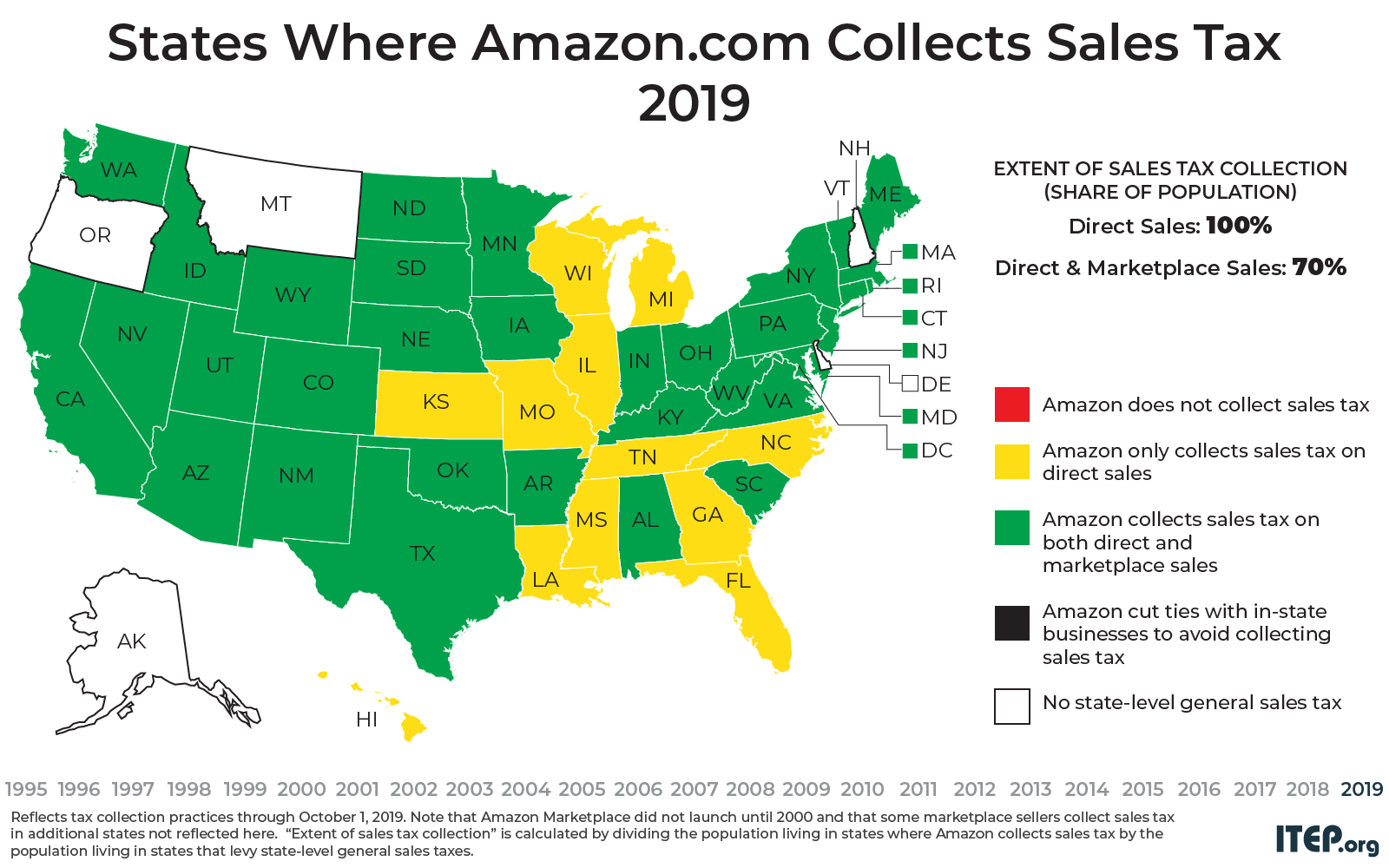

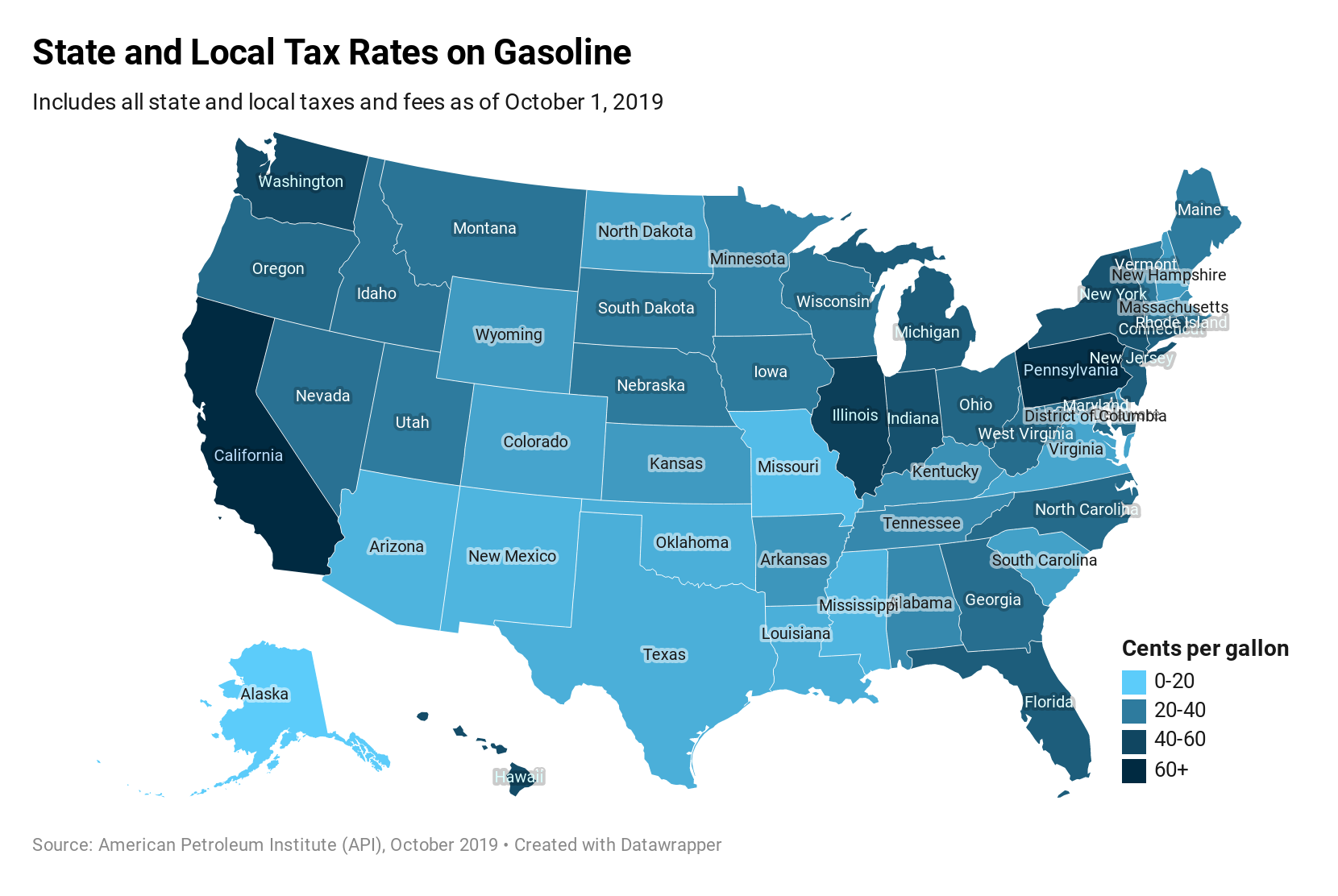

Sales Taxes In The United States Wikiwand

How Do State And Local Sales Taxes Work Tax Policy Center

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax Tax State Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

South Dakota Motor Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Tem South Dakota Bill Of Sale Car Bill Of Sale Template

Sales Tax On Cars And Vehicles In South Dakota

State Corporate Income Tax Rates And Brackets Tax Foundation

North Carolina Sales Tax Small Business Guide Truic

Minnesota Bill Of Sale Form For Ibm Storage Equipment Download The Free Printable Basic Bill Of Sale Blank Form Minnesota Bill Of Sale Template Hennepin County

State And Local Sales Taxes In 2012 Tax Foundation

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Taxes In The United States Wikiwand